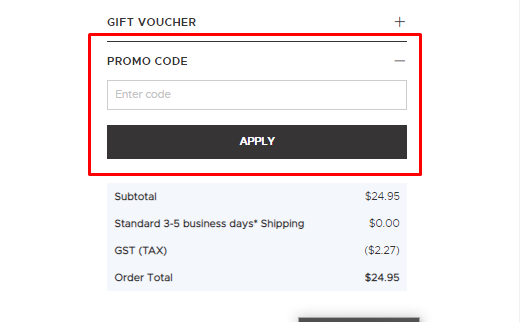

You can find deals online if you’re looking to save on tax-filing software. Just look for the box that says “Have a promo code?” and add your coupon to your cart before you checkout.

Whether you owe or not, filing your taxes is an important responsibility.

Real-Time Updates

Managing tax returns requires accurate and up-to-date information. Top-tier tax software offers real-time updates, eliminating the need to import data manually. This feature allows preparers to monitor the progress of their work, saving time and minimizing the risk of errors.

Top-tier tax preparation software integrates with other systems to enable streamlined workflows. These include accounting platforms and other relevant sources, allowing a direct import of data. Furthermore, a cloud storage system offers security and redundancy, preventing the loss of client data.

Finally, top-tier tax preparation software can handle complex scenarios with ease. This helps to build confidence in preparers and empowers them to navigate difficult situations confidently. It also supports them in making informed decisions and optimizing their clients’ tax outcomes.

When choosing a tax-prep program, consider your specific needs and budget. It would help if you looked at https://www.retailmenot.com/view/turbotax.intuit.com. It is also important to compare prices between different retailers and online sites.

User-Friendly Interfaces

The correct tax software can help you maximize deductions and compliance with the ever-evolving federal and state laws. It can also save time and effort by automating repetitive tasks and simplifying complex filing processes. In addition, it helps you keep track of new tax deductions and credits to ensure that your clients’ returns are complete and accurate.

Specialized tax software is a fundamental component of any professional accounting practice. It is designed to streamline tax filing workflows and provide comprehensive functionalities, including e-filing options and data import/export features. It can also be customized for a specific type of tax service (individual, business, international).

Most tax preparation software programs have user-friendly interfaces that simplify navigation, even for non-technical users. They also come with robust error-checking mechanisms that ensure accuracy and compliance with tax regulations. Moreover, many of these tools allow you to upload returns from previous years and W-2 forms, saving valuable time.

Another advantage of using tax software is that it provides the flexibility to work from home or on the go. This lets you stay on top of your client’s deadlines and avoid missing crucial tax-related news or events. It also lets you share documents with clients in real time, making collaboration effortless.

In addition, tax software programs can integrate seamlessly with client portals, automated payment systems, tiered pricing software, and proposal software. They can also facilitate collaboration between tax professionals and their clients by offering secure cloud storage, protecting client information from cyber threats.

Error-Checking Features

An effective tax software solution must be equipped with robust error-checking features. These checks can help preparers avoid costly errors and update their clients on the latest tax laws. Additionally, the platform should provide various tools for handling complex returns. For example, it should allow users to import data from previous filings and W-2 and investment income documents. It should also allow for quick and easy document retrieval and storage.

The best tax preparation software programs offer a user-friendly interface that newbies can easily navigate. This is crucial as it reduces the time spent learning the software and enables them to complete their returns quickly. Top-tier solutions offer step-by-step guidance and comprehensive tutorials for navigating complex tax scenarios.

Moreover, top-tier software should be capable of handling a high volume of client returns efficiently. This will save valuable time and resources, especially during peak season.

Top-tier tax preparation software programs have built-in mechanisms to check for errors. These mechanisms can cross-reference tax laws and regulations with previous return data to identify inconsistencies and omissions. This can help minimize costly mistakes, which are common in the industry.

Resource Optimization

Resource optimization is a process that maximizes the efficiency and value of your business’s available resources. This could be in the form of manpower, raw materials, machinery, or financial capital. Resource optimization enables employees to work with greater productivity and efficiency while improving overall business outcomes. In addition, it can also reduce environmental impact and cut costs.

The resource optimization capabilities of tax preparation software are a significant advantage for new or established businesses. The software provides automated processes that eliminate the need for manual data entry and streamline repetitive tasks. This allows tax professionals to focus on more complex aspects of the job, such as client consultations and the preparation of tax returns. Additionally, the software’s built-in compliance checks reduce the risk of errors.

Many top-tier tax preparation software programs provide comprehensive customer support. This feature allows tax preparers to communicate with the company via email or phone easily. In addition, the software’s ability to import previous returns makes it easier for preparers to ensure consistency and identify changes.

Client Collaboration

Regarding tax preparation software, client collaboration capabilities are a vital feature. This is because the ability to communicate with clients securely and efficiently helps improve their experience, making it more enjoyable for both parties. Additionally, the capability to automate data entry can reduce the amount of manual work required. This can save time and money for both clients and preparers.

The best tax preparation software offers a centralized platform for exchanging documents and enabling real-time communication. It also gives clients transparent insight into their returns, improving the overall process. This is especially important during busy seasons when clients can be rushed or distracted by other issues.

In addition, the best tax prep software includes features to handle diverse tax scenarios and compliance checks. This can help ensure that filings are accurate and complete, which can avoid costly mistakes. Moreover, this software is regularly updated to comply with new regulations and laws.